Sharing our latest views, news and updates

Storms never last forever: they eventually pass.

If you have read the news in recent days, the world seems to be full of doom and gloom, and little else.

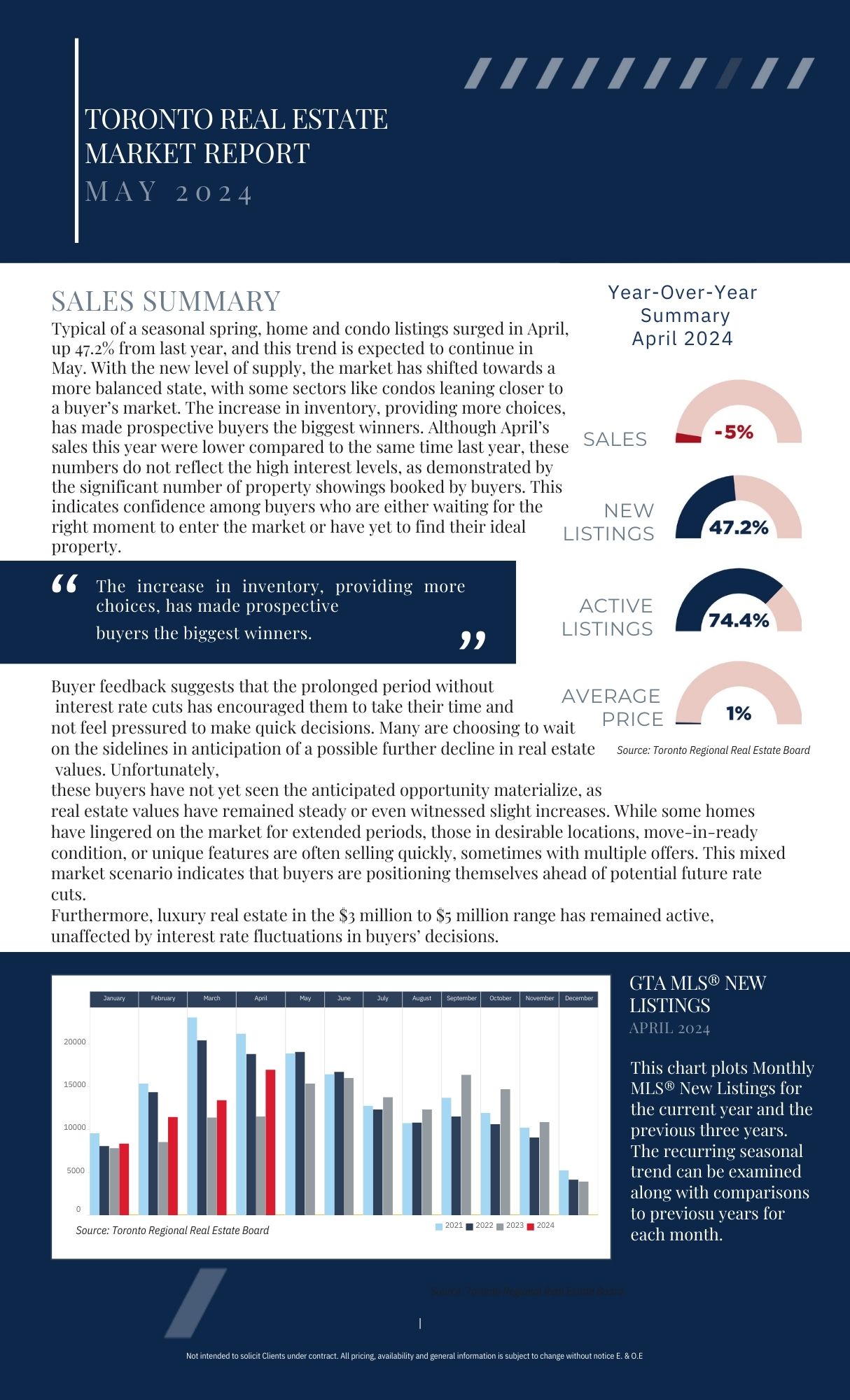

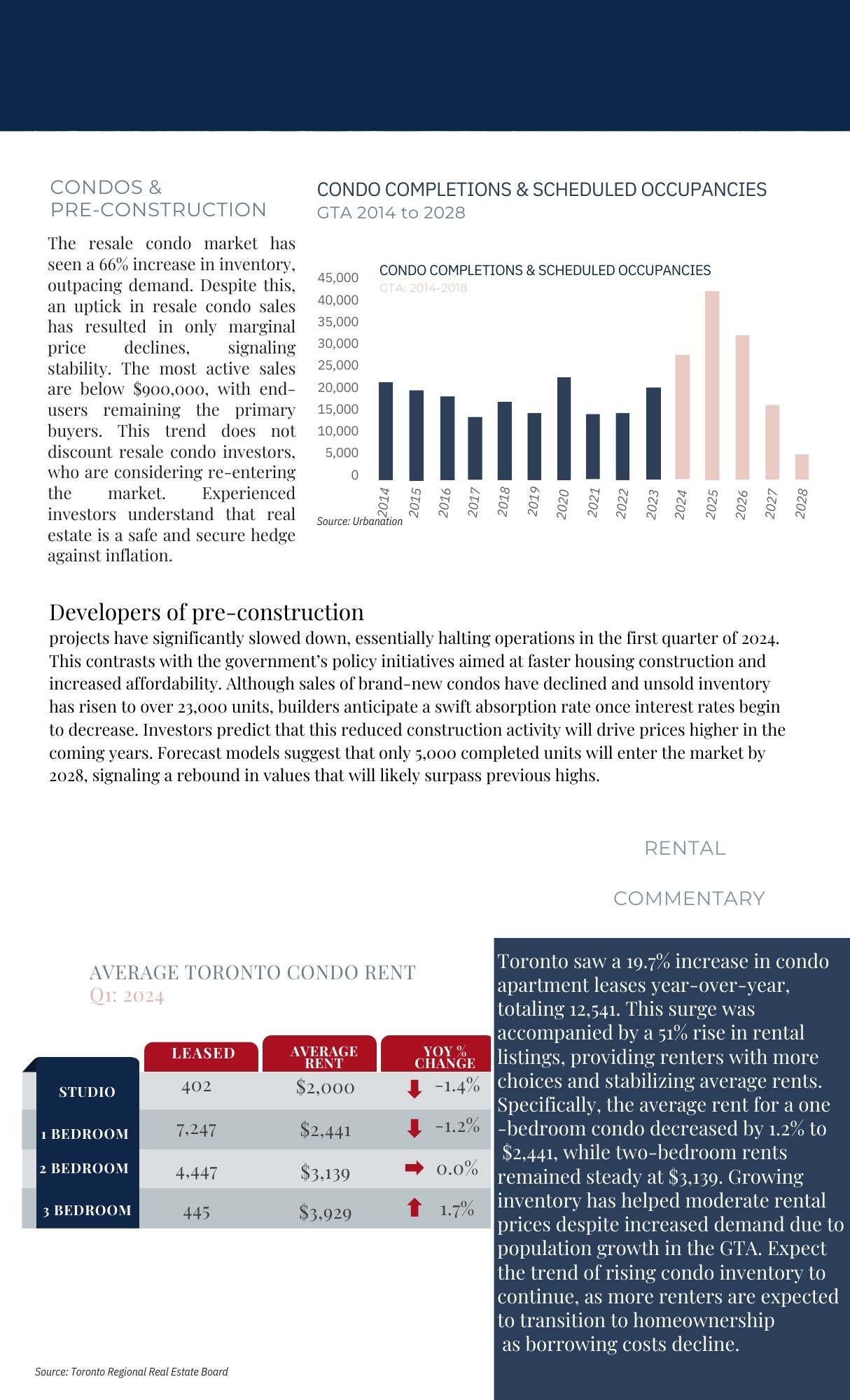

Far be it for the Dash team to comment on the world’s news and how that may impact our markets. What we can comment on are the facts: listings for homes in Canada have climbed significantly in the first quarter of 2024 and housing starts have slowed down yet again. These developments are usually recipes for two things: (1) near term opportunities for purchasing property at discounts; and (2) long-term price escalations.

Housing supply hitting the resale markets has increased by 6.5% month-over-month without (surprisingly) much in the way of price movement, yet. With mortgage rates seemingly on the verge of cuts, as we alluded to in our last newsletter, this seems like a good time to look for deals in the market. Before a surge in demand (i.e. buyers) led by a positive change in mortgage rates.

Ultimately, our outlook for the GTA housing market from a pricing standpoint remains unchanged. Fewer homes/residential units will be available to the market for years to come due to the lack of new supply in the pipeline. In the fullness of time, we expect home prices to continue to rise in and around the GTA with interest rates settling down to their average long-term range. This will inevitably spurr new development, but supply will lag demand by some margin resulting in higher average housing costs.

That makes the current market unique in that supply of properties for sale is seemingly outpacing demand from buyers, creating buying opportunities for those with the means and appropriate risk tolerances.

Whichever way you view the real estate market, your decisions ought to align with your financial goals and risk appetites. As always, our portfolio managers and colleagues are here to assist you in achieving those goals. We look forward to the future with you!

Yours very truly,

DASH Property Management

Market view

Given the current market conditions, Bank of Canada decision to maintain the interest rates without change at 5.00% overnight rate and 7.20% prime rate and the forecast for Q2 2024, it may be a good time to consider buying properties, especially for those looking for long-term investments. The market is expected to tighten, and prices are forecasted to rebound later in 2024 and early 2025, indicating potential capital appreciation in the long run.

However, it’s important to note that real estate investments should align with your individual financial goals and risk tolerance. We invite you to connect with your Portfolio Manager to discuss how we can assist you with achieving your and your family’s goals.

Always here for you,

Team DASH