Buying property is a big decision, regardless of whether you are a seasoned investor or just starting to look into creating wealth in real estate. The process requires deep research and understanding of the market, knowing which developers are a safe bet, knowing how to read your purchase agreement and understand the added costs(can be as high as 10% in addition to the original purchase price), which can potentially make one project more successful and eventually influence the profitability of your investment.

Leveraging our knowledge of the local real estate market in Toronto and GTA, we came up with the initiative to share some valuable observations regarding condo investing in the Toronto condominium market in 2021.

We are getting asked about preferable investment options quite frequently. In the following series, we will be sharing our opinion on the most popular requests.

Today we will be covering pre-construction VS resale condos for a better investment option.

Here is why we think that resale condos are more attractive as an investment option right now.

- Timing

- Start generating rent and payoff mortgage sooner

- Enjoy market appreciation now

- Liquidity

It may take a minimum of four to five years for a pre-construction condo to be completed. This can be a great opportunity for those, who need time to accumulate capital for immediate purchase. A down payment required on pre-construction projects is typically 20% within 12-18 months (varies between projects). In competitive markets like Toronto by the time the unit is ready, it will be valued at a higher price than the purchase price, meaning your gross profit. However, if you are expecting an immediate/quick ROI, this route wouldn’t be right for you. During the years of construction, you won’t be able to do anything with the asset. Even at the occupancy stage when the owner-to-be is allowed to move-in or rent out the property (not always allowed), it can be challenging to start seeing any income, as the project is still under construction and many of the common areas are unfinished (lobby, gym, party room, corridors etc). A resale condo can give you the freedom to put your investment to work right away, as short as a week after the purchase.

- The Numbers Game

- Maintenance fee

- Price per square foot

- Record low mortgage rates

The ability to enter the Toronto condo market with a smaller budget is higher with resale projects as you can buy knowing exactly what your financing option and can obtain a mortgage pre-approval prior to buying, whereas in new construction you hope you will be getting a mortgage but no guarantees . With resale you can get 80% financing whereas as per mortgage brokers getting 80% financing on new construction is more difficult.

Maintenance fees tend to increase at a more predictable rate (5%-10% on average per year), whereas in new condominiums the increase from year 1 to year 2 tends to increase much more (20%-50% is not uncommon).

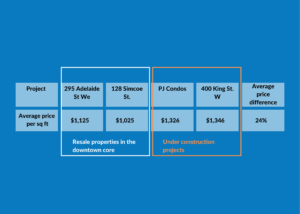

A closer look at the actual pricing numbers shows that prices per sq ft in resale units are 24% percent lower (on average) than those in pre-construction condos. It seems like developers have already calculated your future profit and included it in the pricing.

You can see a significant difference in the numbers below.

Table 1. Comparison between resale and pre-construction projects alternatives:

While buying a resale condo you’ll need to have your financing and deposit money (20%) ready on closing, which would be in two to four months. With pre-construction it is typically a 20% downpayment in the first year, followed by GST/HST, development charges, TARION fee, meter fees and other costs due years later (on average an addition of 10% of the purchase price of a pre-construction unit).

Conclusion:

Whether you decide to buy new property and wait a few years or realize existing market opportunities and buy resale property make sure you are using the help of a professional and experienced realtor who can guide you through the process and set you to success. You should avoid unpleasant surprises on your closing day and scramble for unaccounted funds.

We have helped our clients buy smart since 2002 and feel a big satisfaction that we managed to increase their personal wealth. We invite you to contact our team without any commitment to find out how we can help you too.

Contact us at info@dashpm.ca or call now 416-222-6175.