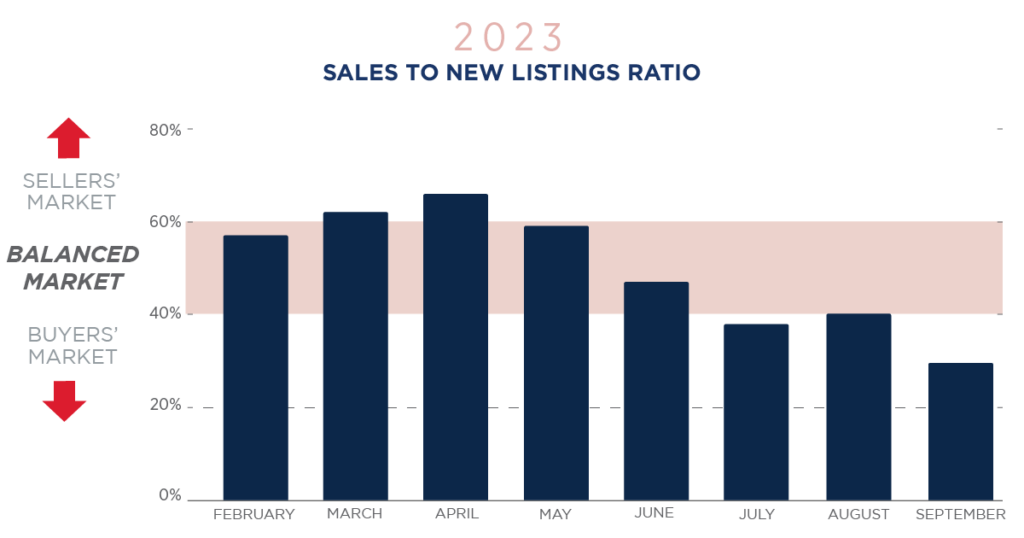

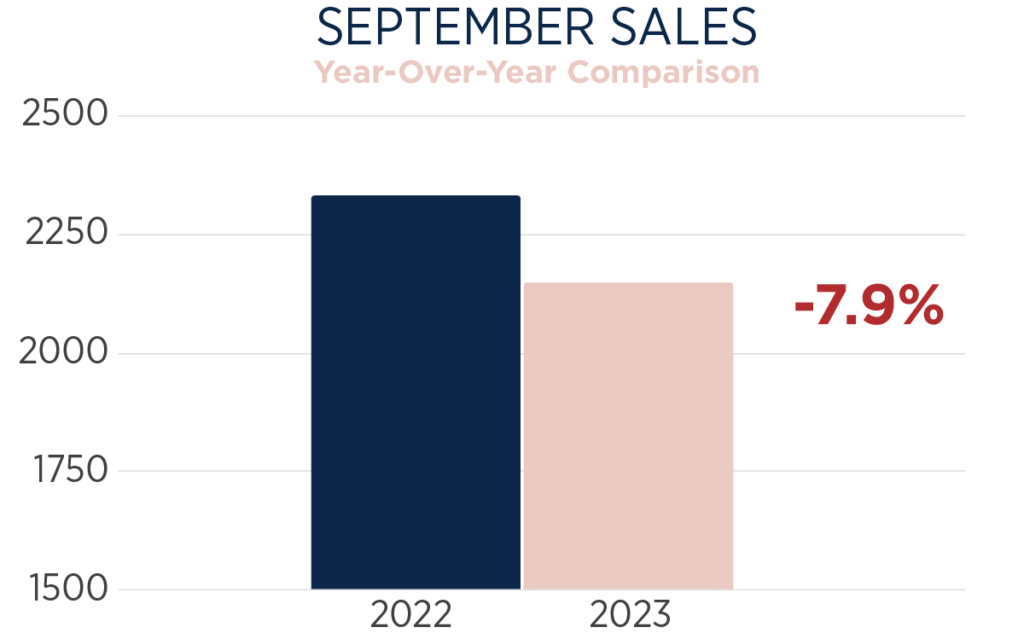

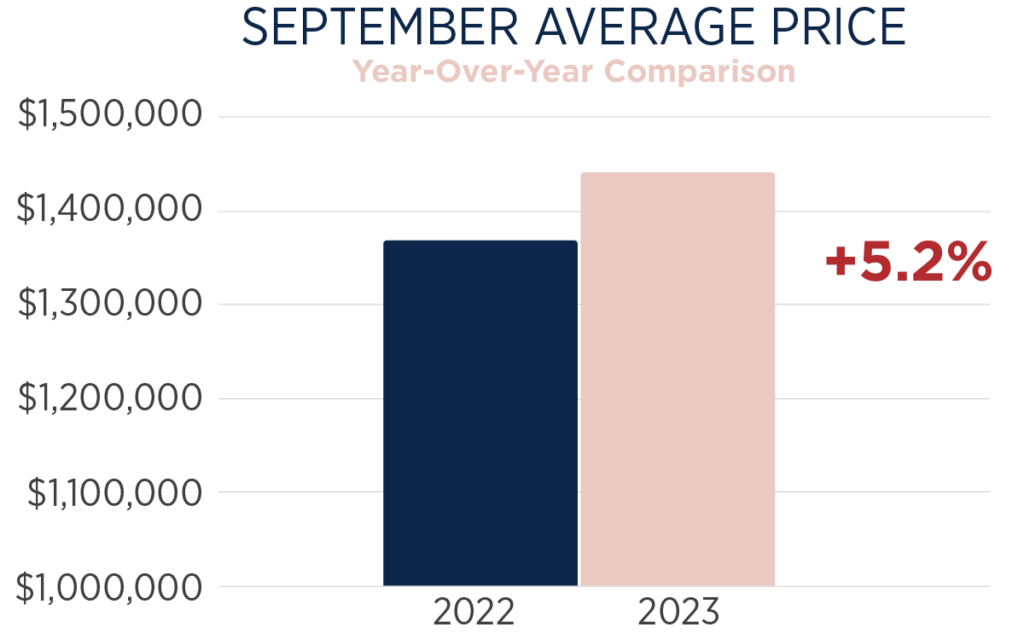

“Revision Of Toronto Housing Forecast Due To Tanking Market But Prices Are Still Going Up”Toronto’s real estate market may be in a months-long slump thanks to prohibitive interest rates, but despite a serious plunge in the number of sales, prices haven’t been following suit — and some stakeholders are saying they are due to actually increase by the end of the year. The experts at Royal LePage have amended their earlier prediction for the direction the market will go as we head into winter in light of perpetually low sales volumes each month, but still anticipate the average price of a home in the GTA will rise 9 per cent from what it was at the same time last year (versus the 11 per cent they had forecasted earlier). This figure is based on the fact that prices in the region were up 4.5 per cent in the third quarter of this year compared with the third quarter of 2022, hitting $1,147,400 — an amount that was notably 2.8 per cent lower than what the typical home was selling for in the previous quarter of the year. If the realty firm is correct, prices in the Toronto area will surge up to around $1,164,665, which marks the second-largest jump for any of the Canadian locales surveyed. Only Calgary is set to see its average home price accelerate more — by 9.5 per cent instead of 9, but to a much lower $656,015. Out of the cities included in this latest report, Regina is set to stay the cheapest place in which to purchase a home, with a projected price of $373,984, on average, by year’s end. Next is Winnipeg at $389,880, Edmonton at $439,913 and Halifax at $501,830. Greater Vancouver is, as usual, the most expensive, with prices expected to climb to $1,293,523 by Q4 2023, followed by Toronto at the aforementioned $1,164,665, Ottawa at $770,293 and Calgary at $656,015. “The aggregate price of a home in Canada increased 3.6 per cent year over year to $802,900 in the third quarter of 2023. On a quarter-over-quarter basis, however, the price decreased by 0.8 per cent, indicating that while many Canadians have adjusted to the increased cost of borrowing, elevated interest rates continue to impact activity in markets across the country,” the release reads. “While trading volumes in most regions remain sluggish, Canada’s housing market is on solid footing, with pent-up demand building. We don’t anticipate a material change in property prices through the remainder of the year.” Royal LePage’s team adds that even with more listings available, housing stock is still “well below the level needed to keep a lid on property price increases” across Canada. “Rent In Toronto Has Become More Affordable”You’d be hard-pressed to find a renter in Toronto who isn’t paying a preposterous amount for what they’re getting — and devoting all of their income to keeping a roof over their head in the process — but one new study says that despite prices continuously pushing to new heights, renting in Toronto is actually more affordable now than a few years ago. The report, from Online Mortgage Advisor, compared average monthly rent bills in cities across the globe in 2022 to the same figures from 2018, then did the same for the average salaries of residents. The findings, released last week, indicate that while the typical tenant in Toronto was allocating 45.51 per cent of their income to housing last year, things were actually worse in 2018, when they would have been handing over around 57.26 per cent of their earnings for rent alone. This change over four years marks “the biggest positive change in rental affordability in Canada, as well as the biggest in North America” versus other major cities, the firm writes. But there’s no doubt most who live here would scoff at the assertion. Given the unprecedented inflationary environment Canadians have been struggling through for many months now, it would be interesting to see how annual stats for 2023 would measure up to analysis. While these more amplified pressures began in 2021 and peaked to the most accelerated rate of inflation in many decades in mid-2022, rent in particular was 6.5 per cent higher in August 2023 than it was in the same month of 2022, and is now a top cause of our sky-high Consumer Price Index even though headline inflation has eased somewhat. Add to this the fact that the cost of other necessities have risen to untenable levels — grocery bills, for example, were up 8 per cent year-over-year in August — and it seems doubtful that the cost of living is any more affordable for the average citizen, even if the average rent price in Toronto technically is compared to the average income. Other interesting takeaways from the report include that 45.5 per cent of cities became less affordable to rent over the years studied, and that Toronto came in eighth in North America for increase in affordability for purchasing property (the average local’s wages could afford them a hilarious four square metres of property in 2019, and 4.6 in 2022). Also, Moncton, New Brunswick had the most drastic reduction in affordability in Canada by the metric employed, with locals having to put 36 per cent of their paycheque toward rent in 2022, but only 25 per cent in 2018 — numbers that are, of course, nothing compared to Toronto. |