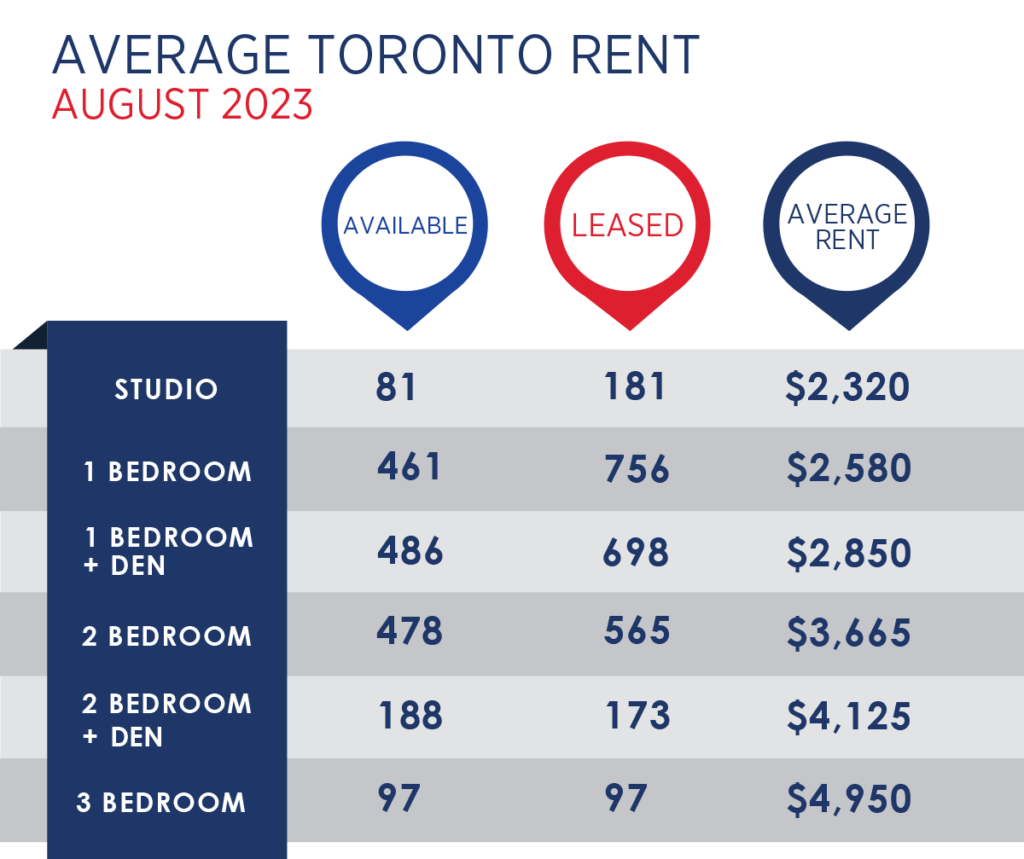

“New Rental Registry Gives Visibility To People’s Pay for Rent”Ever been curious about how much your neighbours have to shell out in rent every month in Toronto? Well, a new Ontario rental registry lets you investigate just that by exploring self-reported rental prices across Toronto in an effort to preserve affordability in the residential market. Designed by non-profit organization, Vivre en Ville, the free registry has already amassed thousands of listed rents in virtually every neighbourhood in the city despite only being launched on Tuesday. The open data platform is crowdsourced and allows you to browse information regarding a unit’s rent, monthly electricity charges, permission to have a pet, and other specific characteristics. By hovering over a map of the city, you can click on or search specific addresses to analyze patterns across rent-controlled buildings versus units subject to unregulated rent increases. “The lack of proper data about the rental situation has made it difficult to deal with the housing crisis. Here in Toronto there are huge differences in rents and practices between different landlords and buildings,” said Dr. Alan Walks, Professor of Geography, Geomatics, and Environment at the University of Toronto. “Above-guideline rent increases have been used for very different ends — many unrelated to paying for needed maintenance — including tenant harassment, profiteering, and eviction. This rental registry will provide the valuable data we need to understand what is going on and come up with policies that address the underlying problems.” In order to register, you are asked to provide the address of your unit, the cost of rent for a given period, the size of your unit, and an email address. You will also be asked for other information concerning the terms of your lease and demographics, but this section is completely optional. A similar registry was launched in Quebec in the spring of 2022, with the organization seeking to increase transparency in the residential market and tackle the unprecedented surge in rent prices across Ontario. “Major Redevelopment Of Toronto Mall Closer To Reality!”Toronto malls once dominated the local retail scene, but are facing unprecedented challenges amid the rise of online shopping and same-day delivery. Once-mighty establishments like Fairview Mall are now dealing with the reality of declining traffic and soaring land values, leading to a rethink of how these shopping centres utilize their vast expanses of land. Cadillac Fairview (CF) and development partner SHAPE have been refining plans to build a new community surrounding the mall that they hope will bring a critical mass of new residents to support the shopping centre generations into the future. A development application was submitted to Toronto city planners back in April 2022, outlining plans to surround CF Fairview Mall with a new community that will replace existing surface parking, driveways, and an above-ground parking garage, bringing thousands of residential units in its place. Following over a year of public consultation and feedback from city planners, a revised plan was tabled in early September, incorporating several changes to refine the Hariri Pontarini Architects-designed redevelopment plan. The initial 2022 proposal detailed the initial phase in what will ultimately be a four-phase redevelopment bringing approximately 4,700 residential units in 310,000 square metres of residential, and up to 40,000 square metres of commercial and office space to the site. That plan called for rental and condo towers proposed at heights of 58, 48, and 38 storeys, though following feedback from City staff, both of the taller towers in the proposed first phase have been whittled down in the updated Sept. 2023 submission, which proposes towers of 52, 45, and 38 storeys. The revised plan for the first phase comes with reductions in the total floor area (dropping by 7,622 square metres down to 97,209 square metres), and residential space (reduced by 7,345 square metres to a new total of 96,947 square metres). The retail component has been slashed in half, dropping from 539 square metres down to 262 square metres. All of these changes impact the loadout of the complex, including a reduction in the proposed unit count from 1,416 to 1,323, and the axing of 172 parking spaces for a new total of 1,062. The bicycle parking component has also been reduced to reflect the drop in units, losing 60 spaces for a new plan of 1,009. Several smaller refinements have been incorporated based on feedback from City staff that aim to enhance the community’s interaction with its surroundings. One notable revision that characterizes the type of smaller changes being implemented is the addition of an architectural canopy over a forecourt framing two of the towers, which planners state will “create an element of architectural interest, and define the relationship between the building.” The City’s feedback places much of its focus on the buildings’ ground realm, hoping to improve the towers’ integration with the three new public parks totalling 7,840 square metres of parkland dedication, and approximately 8,780 square metres of private open space planned across the site. |