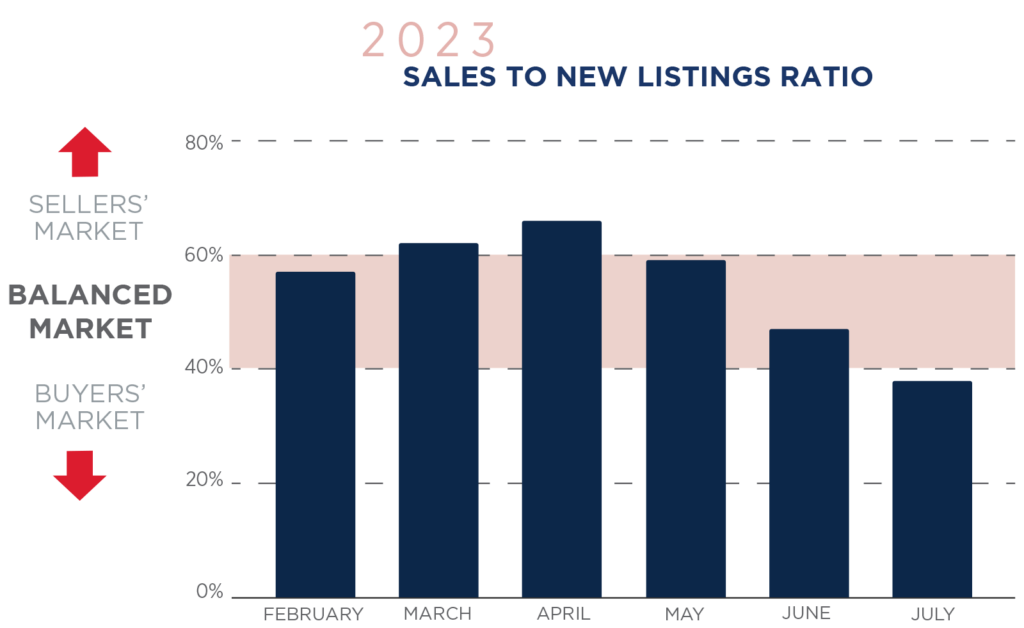

“Key Issue: The Federal Government Tries to Download the Housing Crisis”Canada’s Prime Minister Justin Trudeau was in Hamilton earlier this month to announce that the federal government was investing $45 million to build and repair 214 homes in the region. Considering that Canada needs to build 3.5 million additional homes before 2030 in order to restore housing affordability, it’s surprising that our federal government felt like this tiniest of investments in housing deserved a press conference with our Prime Minister. But the Prime Minister did make the most of the opportunity by laying out his government’s latest views regarding Canada’s housing crisis when he said: “I’ll be blunt as well – housing isn’t a primary federal responsibility. It’s not something that we have direct carriage of. But it’s something we can and must help with.” The Prime Minister’s comments are deeply problematic for a number of reasons. While the provinces and municipalities have far more control over the supply of housing through provincial planning and municipal zoning, the federal government controls virtually every aspect of the demand for housing. Federal agencies, including the Office of the Superintendent of Financial Institutions (OSFI) and Canada Mortgage and Housing Corporation (CMHC), control the mortgage underwriting guidelines for mortgages in Canada. Federally backed mortgage insurance is what enables first-time buyers to buy a home with less than a 20% down payment. Perhaps most importantly, the federal government also controls Canada’s population growth rate, which directly impacts the demand for housing in Canada. The fact that Canada’s population is growing far more rapidly than our ability to build homes is one of the primary factors behind Canada’s housing crisis. This is something I discussed in last month’s report. As highlighted by Move Smartly editor Urmi Desai during our August 2023 Real Estate Roundtable, the Prime Minister’s change in his communication strategy is important because it signals the federal government’s desire to download the blame for Canada’s housing crisis to the provinces, most of which are led by conservative premiers. This is a strategy that mirrors the approach of Conservative leader Pierre Pollievre. But instead of blaming Conservative premiers for Canada’s housing crisis, Pollievre is blaming municipal “gatekeepers.” Both federal leaders continue to ignore the federal government’s important role in driving the demand for housing in Canada. Economist Mike Moffatt posted an important question on Twitter last month. Our federal government continues to increase the number of study visas they issue each year, even though they know we don’t have adequate housing for these students because housing is not a “primary responsibility of our federal government.” While our Prime Minister thinks this is an acceptable response, I know many Canadians, foreign students and workers who are experiencing this housing crisis first-hand disagree. “Toronto Real Estate Prices Plunge Over $20,000, Now A Buyer’s Market”Greater Toronto real estate prices are suddenly back to correcting, despite a mini-boom. Toronto Regional Real Estate Board (TRREB) data shows home prices fell in July. Rising interest rates are the first thought, but home sales are still climbing. Home buyers just aren’t able to keep up with sellers—new listings are climbing much faster than sales. Greater Toronto real estate prices are back to falling, following a brief run. The price of TRREB’s seasonally adjusted benchmark, or typical, home fell 2.2% (-$26,000) to $1,158,000 in July. Unadjusted annual growth was positive for the first time in months, showing a 1.3% increase. However, it confirmed lower prices in the month. Annual growth only printed a gain due to a base effect, with prices making a smaller drop in July 2023 than July 2022. Average prices produced a similar trend. The seasonally adjusted average sale price fell 1.8% (-$20,300) to $1,106,000 in July. Average sale prices can be more volatile due to a change in composition, unlike the benchmark. However, recent changes to the benchmark has at least one prominent analyst preferring the average. Historically, the gap between the benchmark and average sounds bigger than reality. One would assume higher interest rates took a bite out of sales, helping to push prices lower. Not the case, with sales actually increasing 7.8% from last year to reach 5,300 homes in July. It was actually the 11.5% surge in new listings, hitting 13,700 homes, that most likely did it. Homes are selling at a higher volume, but so are the number of people listing their home for sale. The sales to new listings ratio (SNLR) shows there’s a glut of inventory for these prices. The ratio fell to just 38% in July, below the threshold of a balanced market (between 40-and-60%). By definition, this is now a buyer’s market. That doesn’t mean buyers are going ham, but they’re in control of the incentive. If the market maintains this ratio, analysts generally expect home prices to fall. Surprisingly, the SNLR is even lower than last year, when price drops were even sharper. However, the market doesn’t seem to be triggering the same type of discussion this time around. It’s an interesting change in sentiment, potentially indicating buyers piling into falling prices see it as temporary. That can be a problem for the Bank of Canada (BoC) down the road, but that’s another article. Worth mentioning, though! Rising interest rates are certainly playing a role in this market, but not the one most expect. Rising rates typically cool home sales, but home sales are climbing compared to last year. By rates limiting budgets, home prices have had to come down to keep sales and inventory flowing. Most sellers are unlikely to be opposed to a mild pullback, following sharp gains for two decades. The most interesting impact is how rising rates are helping to shape inventory. It would be uncharacteristic for a surge of homeowners to upgrade with rising rates. Yet, there’s suddenly a lot more sellers looking to unload property. This may be a reflection of Canada’s investor-dominated real estate market. Investors are looking at stalling home price growth, with bond yields higher than rental yields. It’s impossible to determine if the sellers are investors with the current data, but shifting incentives tend to shift investor activity. |