Dear clients,

We hope this letter finds you well. As you are no doubt aware, inflation has surged globally and the Greater Toronto Area (GTA) real estate market is not exempt from such inflationary pressures. Despite the uncertainty in the markets today, there is a current of fundamental positivity that we would like to share with you.

As a team, DASH has lived through and has shepherded clients through various challenging times that had the potential to severely impact the local real estate market and our investments. To name few: the Great Recession of 2007-2009, the 2009 swine flu epidemic in Canada, the increase of HST from 5% to 13%, the introduction of the City of Toronto Land Transfer Tax, the expansion of rent control in Ontario, the rollout of the Fair Housing Plan in 2017 and more specifically the Non-Resident Speculation Tax, the short-lived real estate market downturn in 2017-2018 and, most recently, the coronavirus (COVID-19) pandemic.

All of which is to say — is this time really all that different?

Historically, these events cooled the markets for a short period and were followed by substantial increases in real estate activity and prices; exceeding what was anticipated before the relevant event.

The question is why? Is the GTA real estate market destined to rise forever?

We cannot predict the peaks, troughs or durations of market trends. However, we can look at the fundamentals of the market — metrics like supply versus demand, immigration, the cost of developing and constructing in the GTA and the insights gathered from our clients to arrive at a thesis about how the real estate market will fare in the face of broader market turmoil.

Supply Versus Demand

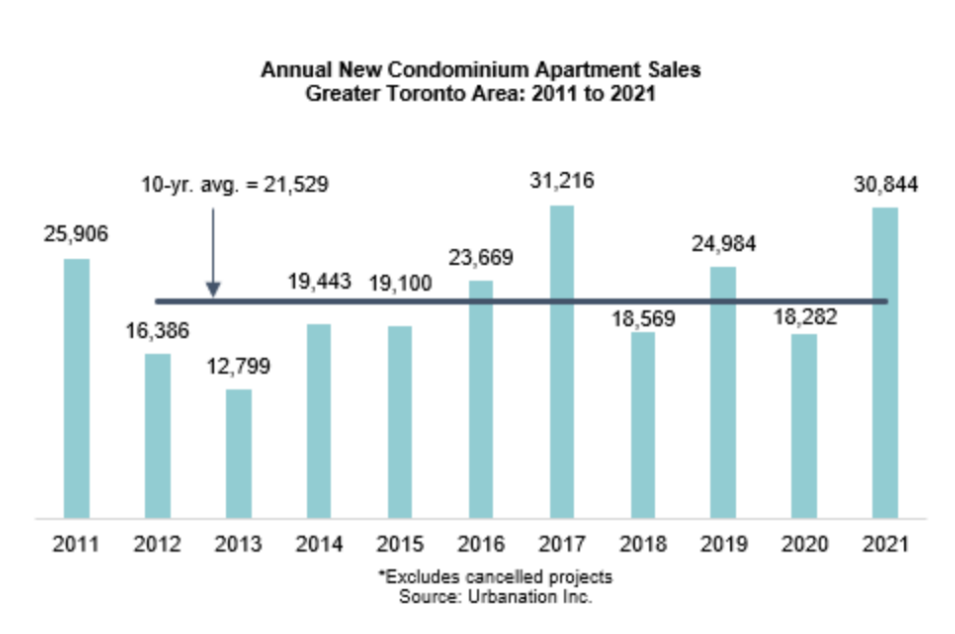

According to the Altus Group, 46,651 new homes were sold in the GTA in 2021. Of those homes, 30,844 were condominium units, which accounted for approximately 66%.

Based on the figure, we can see that 2021 was a busy year for new developments second only to 2017 in terms of the number of new condo unit sales.

When taking the above ten-year average of units sold and accounting for the total number of units actually sold over that 10 year period versus the expected total sales based on the average, there is a deficit of 2,138 units sold during that period. In other words, despite the number of sales, there continues to be an unsatisfied demand.

Since an average condo unit is occupied by 1.5 individuals, despite the fair increase in new housing units, supply still fails to keep up with the demand. In 2021, only about 19,000 new units were completed while immigration numbers were at record high.

Immigration

Canada was and continues to be one of the safest, most immigrant-friendly and stable democracies in the world. As a result, it continues to be a desirable country for immigration and investment. With geopolitical and climate changes globally, it is our opinion that Canada will not only continue to be a desirable place to invest and live, but it will continue to be so at an increasing rate.

According to the Government of Canada, the following are the anticipated numbers of new immigrants to Canada from 2021 to 2023: 401,000 in 2021, 411,000 in 2022 and 421,000 in 2023.

Of those new immigrants, an estimated 70% will settle in the GTA. These immigration numbers exclude the natural growth rate, young adults who leave their parents’ homes, divorces and thousands of individuals relocating for study and work purposes; many of whom have strong financial support which, in turn, can offer higher prices for both rental and purchasing purposes.

It is patently obvious that the need for new housing in the GTA greatly outpaces the rate of new housing unit sales. These new housing units, 46,651 of which Altus Group reported as sold in 2021, take an average three years to complete, and in the case of condominium units, house an average 1.5 people. Assuming none of the projects sold in 2021 are canceled, those new units will merely house 46,266 people who will live in condominiums. This is far short of the approximately 287,700 new individuals expected to settle in the GTA.

Just a few months ago, we saw an approximate 12+ month period in which many homes and condo units received multiple offers when offered for sale and sold well over the asking price. Today, we are seeing a similar trend materialize in the lease market while sales have become more muted. This is not altogether surprising, as new immigrants typically lease in the first few years before generating a downpayment sufficient for purchases.

The shift from multiple offers to buy to multiple offers to lease seems to be a clear indication that housing demand continues to outpace supply. In other words, the fundamental conditions in the market have not changed. There is a supply bottleneck. And, all things being equal, when supply outstrips demand, prices increase.

Cost of Developing and Constructing

In 2012, we added to the DASH family development arm. In 2020, we completed our first project, Avenue 151 in Yorkville. Although the development process in Toronto was not foreign to us, we gained additional insight into the delays and obstacles a development project will confront in Toronto from conception to completion. Today, we are working on three new development projects and we continue to experience these challenges while attempting to add new housing options in Toronto.

From land acquisition to the completion of a project, the average time period is currently five years in Toronto. As with most things, during this time, the cost of construction escalates. Over the last five years alone, hard costs for constructing condominiums have increased by approximately 40%. In that same period, the City of Toronto deemed it appropriate to increase its development fees for newly constructed units by about 215%.

In most cases, these added costs are passed on to purchasers. The question is simply to what extent can purchasers absorb these cost escalations? In circumstances where purchasers cannot absorb ever-increasing costs, it is our belief that the existing lack of supply will only be exacerbated by the slow pace of the approval process for new developments in the City of Toronto and increasing immigration. And so, in the short term, all things being equal, we view the rental market bullishly and believe the price of resale properties will increase faster than that of proposed new units.

NO INVESTMENT ADVICE AND DISCLAIMER

This document and the information contained herein are for informational purposes only and do not constitute and should not be construed as legal, tax, investment, financial or other advice of any kind or nature. By accepting this document, you agree that you understand, acknowledge and agree to the restrictions and disclaimers contained herein. Nothing contained in this document or on any of our websites shall be construed nor constitute a solicitation, recommendation, endorsement or offer by DASH or any third party service provider to buy, sell or lease any real estate or other investment in Ontario or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

This document and the information herein is information of a general nature and does not address the circumstances of any particular individual, person or entity. Certain information herein is based on or is derived from information from third-party sources. DASH has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Nothing in this document nor the information herein constitutes professional and/or financial advice, nor does any information in this document constitute a comprehensive or complete statement of the matters discussed.

Further, nothing in this document constitutes or shall be construed as the making of any representations or warranties regarding any information contained in this letter by any person and the reader understands and acknowledges that neither DASH nor any other person shall have any liability in connection with the use of any or all of the information contained in this document. DASH is not a fiduciary by virtue of any person’s use of this document or the information contained herein. You alone assume sole responsibility for evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information. By accepting and reviewing this document and the information contained herein, you agree not to hold DASH, its affiliates, officers, directors, employees or any third party service provider liable for any possible claim for damages (of any kind or nature, whether in contract or tort) arising from any decision you make based on information or other content made available to you herein. Finally, this document, including the information herein, may not be copied, reproduced, republished, posted, transmitted, distributed or disclosed, in whole or in part, to another person in any way without the prior written consent of DASH.